Money market funds are a common alternative for investors looking to ensure their investments are safe and also earn a decent returns.

The most savvy investors look for secure and stable investments regardless of whether the market is volatile.

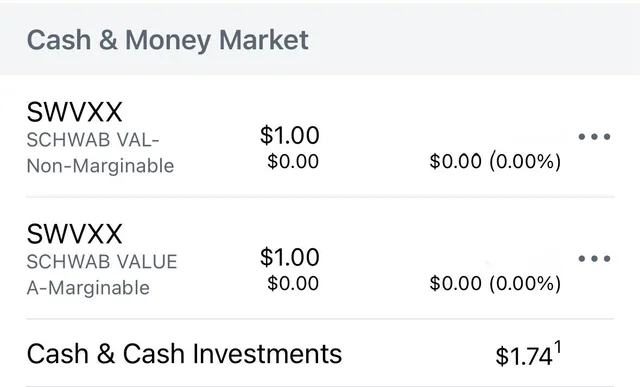

This Schwab Value Advantage Fund(r) (SWVXX) is the best option for investors looking to increase their return with a minimum of liquidity while minimizing risk.

With the abundance of alternatives among the options available, there is a single option that stands out. Schwab Money Market Fund SWVXX is a symbol of stability and reliability amid the turbulent waters of the market for financial instruments.

Given the rocky track record and a belt-tight cost ratio, It’s not surprising that SWVXX has grown into an iconic name for investors.

This complete guide will go over some of the main features that make up Schwab Money Market Fund SWVXX. Schwab Money Market Fund SWVXX in order to explain how it can be an ideal option for your portfolio of investments.

How to Choose a Money Market Mutual Fund?

These funds are provided by various financial institutions, including banks or brokerage firms, as well as mutual fund firms.

- Yield: You’ll need to evaluate the yield of a fund with other funds so that you can ensure you’re getting the highest return for your money.

- Expense ratio The fund charges the expense rate that comes directly from the amount that you earn when you invest. Everything else being equally, the less the cost ratio more favorable for investors.

- Fund type: Consider whether you’d like to put your money into a prime, municipal, or market fund. These funds can appeal to those who are in the highest tax levels.

- Other charges: Be sure to take note of any other fees that you might incur when purchasing and selling money market securities.

How Do Money Market Funds Work?

Funds for the money market work by pooling the funds from a number of investors, and putting it into an investment portfolio that is fixed-income securities that are selected based on three criteria that include good creditworthiness, short duration as well as good liquidity.

It typically includes Treasury bills, commercial papers CDs, repurchase agreements, and CDs However, the precise structure of a money market fund is determined by its kind.

The securities portfolio that is the foundation of a money-market fund can help it meet two goals.

One is to ensure the stability of its total value of net assets per share in one dollar whatever the economic conditions.

This helps reduce the volatility of the money market funds and is attractive to those seeking security.

The third goal is to earn regular income. The distributions are derived directly from the interest earnings generated by the fund’s money market portfolio.

The amount of income fluctuates according to the current interest rates. Investors are likely to receive distributions of income frequently, generally every month.

What is Schwab Money Market Fund SWVXX?

The Schwab Value Advantage Fund(r) (SWVXX) is a market fund that is designed to provide investors with the highest amount of income that is consistent with the security of the fund’s principal.

Directed through Charles Schwab Investment Management, SWVXX aims to give a secure and reliable solution for investors seeking to put their money into an asset with low risk, and high returns.

Key Features and Benefits of Schwab Money Market Fund SWVXX?

High Liquidity

SWVXX permits investors to gain access to their money quickly which makes it a great alternative for savings in the event of an emergency or financial goals for the short term.

Competitive Yields

Although it has safety measures The fund aims to provide competitive rates of interest when compared with similar investment choices.

Low Risk

As money-market funds, SWVXX invests in high-quality and short-term bonds, thus lowering the possibility of volatility on markets.

No Minimum Investment

With no minimum investment requirements, SWVXX is accessible to numerous investors, from newbies to experienced investors.

These are the most important things you should be aware of:

Overview of SWVXX:

- SWVXX is the name of a funds for money markets that is offered through Charles Schwab.

- It invests in premium currency instruments for short-term use offered through U.S. and foreign issuers. These include commercial paper, certificate of deposit and other the government’s obligations.

- The aim of the fund is to give the stability, liquidity as well as a yield that is competitive.

Investment Process:

Purchase For investing in SWVXX take these steps:

- Get A Schwab account If you do not already have one, sign up for an account at Charles Schwab.

- You can fund your account Incorporate funds into the account of your Schwab account.

- Order SWVXX Search for SWVXX in your account, and then place the purchase order.

Dividends: SWVXX pays monthly dividends that are based on the most invested amount during the month. Dividends typically are due on the 15th of every month.

Liquidity Selling SWVXX simple. If you decide to sell your order overnight, it will be executed The proceeds of the sale become available next day..

Considerations:

- Tax Impacts Remember that the dividends paid out by SWVXX are not qualified dividends This means that they’re taxed at your most expensive (marginal) amount.

- Minimum investment: SWVXX has no minimum investment requirements which makes it available to investors of all levels.

- Alternative options If you’re allocating an amount that is substantial (over one million) or are in one of the most tax-efficient brackets look into other funds that have greater minimum requirements and the municipal funds for money markets.

How to Invest in Schwab SWVXX?

The process of investing in Schwab Money Market Fund SWVXX or another mutual fund that is offered by Charles Schwab generally requires a couple of actions:

Open an Account: If you don’t have an account at Charles Schwab, then you’ll need to open a new account.

This can be done on the Schwab site or through Schwab’s customer support.

Schwab offers a range of accounts which include brokerage accounts, private accounts for retirement (IRAs) as well as other accounts.

Fund Your Account: Once your account is open, you need to put money into it.

You can do this by transferring online, sending an electronic wire transfer, and depositing a check online. Make sure that you have enough money to invest in the SWVXX..

Research SWVXX: Prior to funding, it is essential to study SWVXX to know its objectives for investing, the risks as well as fees and performance.

The information you need about Schwab Money Market Fund, SWVXX on the Charles Schwab website. This includes the prospectus of the fund, a fact sheet, as well as other pertinent documents.

Place an Order: When you’re prepared to put your money into SWVXX Log in with your Schwab account. Follow the steps to the trading or mutual fund section.

Look up Schwab Money Market Fund SWVXX by using the ticker symbol or fund’s name. Next, make a purchase order for the desired amount of shares.

Review and Confirm: Prior to completing your purchase, check the details of your purchase to verify accuracy. This includes the amount of shares you’re purchasing and the cost per share.

If you are satisfied, sign your purchase to complete the payment.

Monitor Your Investment: When you have invested in the Schwab Money Market Fund SWVXX It’s important to track the investment on a regular basis.

Track the performance of your fund, read any communication from Schwab concerning SWVXX regularly, and reevaluate whether SWVXX remains in alignment with your objectives for investment and your risk tolerance.

Conclusion

The Schwab Value Advantage Money Fund(r) (SWVXX) provides investors with a unique mix of liquidity, stability, and yields that are competitive, so it is a worthy investment to add to your portfolio of investments.

If you’re just beginning to invest or are an experienced investor, SWVXX merits a closer examination as a possible cornerstone in your investment plan.

It is recommended that investors consider this fund Schwab Money Market Fund SWVXX as part of a broad plan of investment that gives the security of financial stability and peace of mind through an investment that is reliable and trustworthy.

This article has highlighted the various aspects of SWVXX explaining its value as an ideal option for people trying to manage their finances effectively.

No matter if you’re an experienced investor or are new to money market fund options, investigating SWVXX can be a beneficial way to secure your financial security.

FAQs

What’s the purpose of SWVXX?

The symbol SWVXX is used as the ticker for a mutual fund known as The Schwab Value Advantage Money Fund. The aim of the fund, as with other money market funds, is to supply the investors with a fairly secure place to store their funds while earning a small amount of rate of return. They typically focus on short-term, premium loans, such as Treasury bills and certificates of deposit (CDs) as well as commercial paper. The main goals of these funds are the preservation of capital in addition to liquidity generation.

What are the dangers when making a bet on SWVXX?

The investment into Schwab Money Market Fund SWVXX is risk-free but is subject to credit, interest rate liquidity, and other regulators, which could affect returns as well as access. In addition, it might not completely protect you from inflation in the longer term.

Is there a minimal cost for an investment in SWVXX?

The investment minimum required for Schwab Money Market Fund SWVXX usually is $1,000. However, it can vary based on the requirements specific to each fund established by the fund, or investment platform.

What’s the return on SWVXX in contrast to other alternatives?

The SWVXX yield usually reflects the current rate of interest for the short term and generally is in line with other money-market funds as well as other similar options for managing cash. However, the yields may fluctuate with time and could be affected by the market’s conditions as well as the investment strategy used by the fund.

Is SWVXX the right choice the way for my needs?

Schwab Money Market Fund SWVXX might be the best option if are looking for low-risk investment and low returns. But you need to consider your objectives in financial terms and tolerance to risk prior to making a decision to invest. A financial adviser could help to determine if the fund meets your expectations.